IR35

Self-employed IR35 rules are designed to work out whether a contractor is someone whos genuinely self-employed rather than a disguised employee for the purposes of paying tax. IR35 also known as intermediary legislation was introduced in 2000 to tackle disguised employment.

Are You Ready For The New Ir35 Rules Fuse Accountants

On September 23 the UK Government announced their mini-budget.

. Those contractors who fall under the IR35 rules will be. The IR35 changes announced in the September Mini-Budget go live in April 2023. September 23 2022 134 pm.

The term IR35 refers to the press release that originally announced the legislation in 1999. The repeal of the off-payroll rules often referred to as IR35 represents a significant change in direction from the government. The term IR35 refers to the press release that originally announced the legislation in 1999.

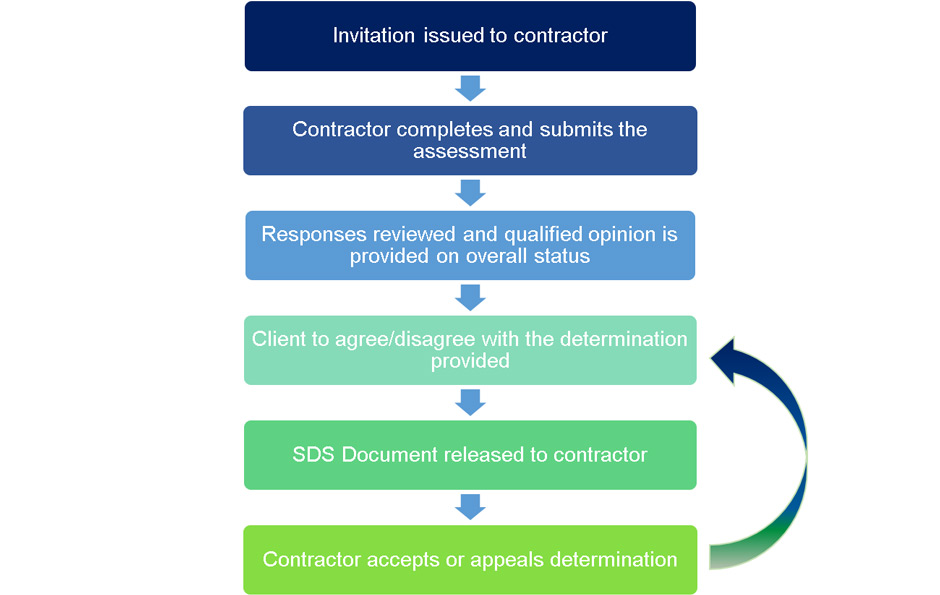

HMRCs IR35 tool Check Employment Status for Tax CEST HMRC introduced CEST in the run up to public sector IR35 reform in 2017. IR35 is a piece of legislation which allows HMRC to treat private contractors as if they were employees. It was built with the intention of helping clients determine the status of contractors they engage the vast majority of whom were inexperienced with regards to the IR35 legislation.

The IR35 tax avoidance reforms were first introduced in the public sector back in April 2017 and ushered in a sizeable shift in responsibility within the extended end-client-to. We use some essential cookies to make this website work. The IR35 rules will result in an increased tax and NI.

Chancellor Kwasi Kwarteng has pledged to simplify so-called IR35 rules which affect self-employed individuals operating through a company in his mini-Budget. Wed like to set additional cookies to understand how you use GOVUK remember your. It was introduced to combat the problem of disguised employment.

IR35 is a reform unveiled in 1999 by the UK tax authorities. Changes to IR35 were outlined in the recent mini-budget. IR35 is governed by Her Majestys Revenue and Customs which absorbed Inland revenue back in 2005.

Inside and Outside IR35. Mind blown is an understatement. IR35 is another name for the off-payroll working rules.

The latest regulation change which came into force in April 2021 forced medium and large businesses in the UK. What does IR stand for in IR35. IR35 was introduced in 2000 and the IR35 rules became law via the Finance Act 2000.

The off-payroll working rules apply on a contract-by. A contract for the purpose of the off-payroll working rules is a written verbal or implied agreement between parties. Essentially IR35 affects all contractors who do not meet HMRCs definition of self employment.

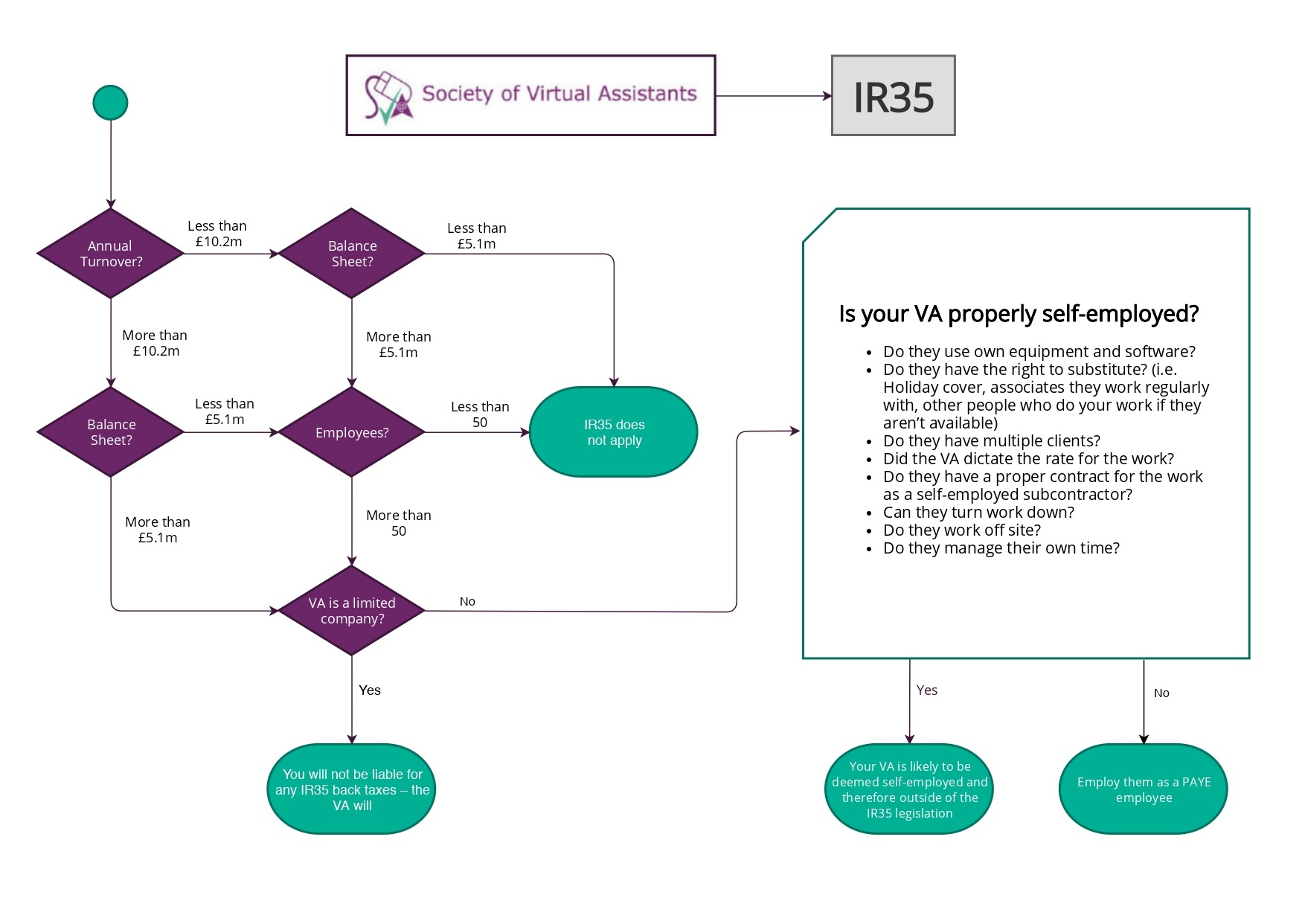

The definition of small business for IR35 exemptions is likely to be based on the definition in the Companies Act which is met if a company meets any two of the three triggers below. The IR stands for Inland Revenue and the 35 is the press release issue number. List of information about off-payroll working IR35.

This is to prevent an employer engaging an employee on a contract basis where the employer will avoid paying Employers National Insurance Contributions or providing employment rights and benefits. And in a surprising twist IR35 changes off-payroll working rules will be repealed from April. Dave Chaplin CEO of IR35 compliance solution IR35 Shield explores and explains what these changes could be and how.

The IR35 Budget Announcement. The rules were inspired by the finding that only 10. The current Chapter 10 rules will remain in place until April 5th 2023 and any work done up to.

IR35 is the abbreviated name for the anti-tax avoidance legislation that was introduced in April 2000. A massive win for contractors in todays mini budget by chancellor Kwasi Kwarteng announcing the repeal. Liability and will prevent contractor companies from retaining profits to grow their business in the future.

Ir35 Tax Rules Will Ring The Changes For Contractors Business Rescue Expert

Ir35 Off Payroll Explained The Ultimate Guide To Ir35 And The Off Payroll Legislation For Hiring Firms Agencies And Contractors Chaplin Dave Gordon Keith 9781527260214 Amazon Com Books

Ir35 Reform April 2021 What It Means For Companies In The Usa Cxc Global

How Will Designers Be Affected By Changes To Ir35 Design Week

Ir35 For Virtual Assistants Society Of Virtual Assistants

Ir35 Reform Delay How Tech Companies And Contractors Should Respond

How Companies Can Prepare For The Ir35 Changes Med Tech Innovation

What Is Ir35 Ir35 Rules Ir 35 Tax Reality Hr

Ir35 Resolve Worsley Manchester Champion

What Is Ir35 A Guide To Its Rule Changes

Ir35 Is Drawing Close Here S How Your Business Needs To Prepare Proclinical Blogs

Working Practices Reflecting Genuine Outside Ir35 Assignment

Ir35 How To Prepare Your Recruitment Agency

Five Questions On Ir35 You Should Know The Answers To Michael Page